Friedman was a supporter of this idea (to heterodox economists, that would probably be argument against indexation!) and it is considered to be an unshakable truth in Iceland. As an example, the minister of business in 2004 said that it would be a bad idea to abolish the indexation of mortgages since unindexed loans had "2-3%" higher real rates than indexed ones. Asgeir Danielsson, an economist at the Central Bank of Iceland, said in March 2009 that if people were risk averse, one should expect real interest rates of indexed loans to be lower than on unindexed loans (to clarify, "unindexed loans" are normal loans where you would pay interest rates every month and the principal would shrink in nominal terms as you paid it down every month)

This is disputable, to say the least. I believe this should be exactly the other way around: unindexed loans should have lower real rate of interests than indexed ones. Also, the economy should be more stable if the loan contracts would be unindexed to the price level. When I got my hands on data that I hadn't seen before, posted in obvious view by the Central Bank itself, I got firmer in that belief.

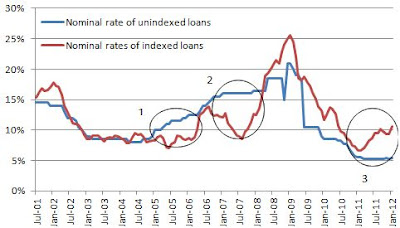

Graph 1 shows the development of nominal interest rates of indexed and unindexed loans. There are three periods that are especially important and they have been circled. Circles 1 and 2 are periods when the CBI was trying everything it could to cool down the economy but because the indexation of mortgages defends the borrowers from the nominal interest rates hikes by the CBI, nothing happened and the punch bowl stayed on the table.

When the punch bowl had finally been emptied and dropped to the floor in 2008, the CBI tried to get the economy going again by lowering its policy rates. But the same problem persisted, this way the other way around: because of the indexation, households' available cash-on-hand after having paid the monthly repayment and interests was hardly or not at all influenced by the CBI dropping interest rates down from record 18%. So the economy never recovered. In the meanwhile, the indexed debt just kept ballooning out as the price level rose.

Graph 1 The nominal rates of unindexed and indexed loans in Iceland

Graph 2 The real rates of unindexed and indexed loans in Iceland

So this is what happens. Because of the indexation of an overwhelming majority of mortgage debt, the interest rate setting mechanism of the Central Bank of Iceland fails. The consequence is that effective interest rates can, as in 2005 and 2007, be too low when they need to be much higher to cool down the economy. Likewise, as in 2009 and 2010, it can happen that effective interest rates are too high when the economy needs it most to get a slacking monetary policy.

Therefore, contrary to the neoclassical belief, it turns out that the economy in Iceland isn't helped at all by the indexation of mortgages and loans, not even in lowering the interest rates as the neoclassicals believe. In fact, the common belief that the economy of Iceland is so unstable because of the Icelandic krona, and therefore needs indexation of mortgages and other loans, is quite likely wrong entirely: the economy of Iceland and the Icelandic krona are unstable because of the indexation of mortgages and loans, not the other way around.

Hi,

ReplyDeleteWhere could I get raw data you used for this graphs?

Central Bank of Iceland, General Interest Rates (http://www.cb.is/statistics/interest-rates/)

ReplyDeleteAnd Statistics Iceland for the CPI

Thanks for answering even though that was kind of dumb question since you pointed out in the post that those come from CB. I was actually looking for it under statistics/interest rates on sedlabanki site but somehow managed not to find it. By the way, you're doing really great job with this blog! Hope I'll get to read you your book someday.

ReplyDeleteBTW. i just noticed something while skimming through OECD surveys on Iceland. in the beginning of 90s OECD was backing restrictions on indexation, in 2006 they advised repealling existing restrictions claiming there's no clear rationale for them. wonder what's rationale for such a policy shift;)

ReplyDeleteThat's very interesting! You don't have links to the surveys do you?

ReplyDeleteSurveys are available for full preview via OECD bookshop website.

ReplyDeleteBut now I see that I didn't read it thoroughly enough. It was more like acknowledging problems (i.e. mismatch in indexation between assets and liabilities), not endorsing specific policy.

1. 1990 http://www.keepeek.com/Digital-Asset-Management/oecd/economics/oecd-economic-surveys-iceland-1990_eco_surveys-isl-1990-en (pg. 68)

2. 1998 http://www.keepeek.com/Digital-Asset-Management/oecd/economics/oecd-economic-surveys-iceland-1998_eco_surveys-isl-1998-en (pg. 70)

and finally in 2006 indexation and restrictions on indexation are mentioned in "Assessment and recommendations".

http://www.keepeek.com/Digital-Asset-Management/oecd/economics/oecd-economic-surveys-iceland-2006_eco_surveys-isl-2006-en