Edit: For those of you who don't know, Iceland's government recently presented the whole debt relief action. As of this morning, each individual who gets a debt relief (91,000 in total or a bit less than a third of the total population) knew how much (s)he is going to get. Here are some news about the whole thing in English:

Mbl.is

Iceland Review

Iceland Review

The Reykjavik Grapevine

=============

Well, not a full-blown jubilee, but a partial one. And no clay tablets were broken or dissolved during this one.

I described in this post the Icelandic debt jubilee and how they were going to do it. Now, a milestone in the matter has been reached: 90% of the applicants have had their loans looked at and a judgement has been reached whether and how much write-off of debt they're going to get. This post describes the bottom line and delves quickly into some potential consequences.

And the source of info & graphs:

The Powerpoint slides from the government

First of all, how much was cancelled?

ISK 80 billion (4.3% of GDP) of indexed household debt. On top of that comes the tax-free allowance to use private pension funds (the third pillar of the pension system) to pay down debt, total ISK 70 billion.

How much will it cost the government?

ISK 100 billion: ISK 80 billion due to the direct write-offs and ISK 20 billion due to lost tax income from private pension funds being paid out. The ISK 80 billion is immediate but the rest is distributed over decades.

How much time will this take?

Effect will be pretty much immediate on the cash-flows of households. The original loan that is being written down will be divided into "New Loan" and "Write-Off" parts. The New Loan will be an exact replica of the original loan minus the amount written off. The Write-Off part will stay on the balance sheet of the household and be written off in chunks. The original plan was to write it off in four years but instead they're going to do it one year.

Four years or one year, does it matter?

Probably not. Strictly speaking, the net-debt situation of the household doesn't improve until the Write-Off part is gone. Some might think that speeding up the cancellation of this debt may speed things up a bit in the economy (ease the access to credit to households) but why so? After all, even if it had been there for four years or 40 years, if the household never pays a penny of the debt and the bank/prospective lender of the household looks rationally at the financial situation of the household as a prospective borrower, why should it matter?

Who's getting his debts cancelled?

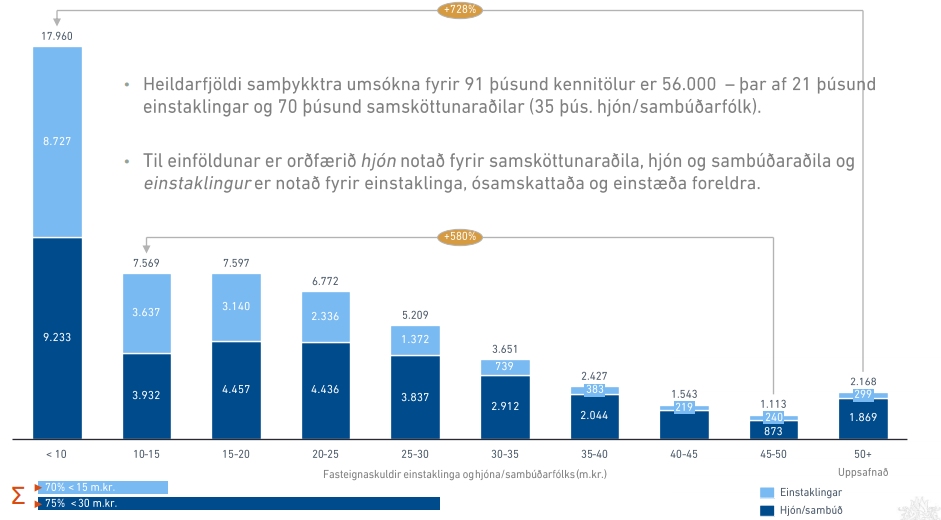

Here is an interesting figure from the powerpoint slides of the government. The columns are number of individuals (dark blue) and couples (light blue) which are getting a part of their debt cancelled. The x-axis is the amount of the original loan (in ISK millions). So, basically, looking at the numbers, it's the ones that are in low debt that are getting their loans written down. Do note that we can't say anything about the ages of the individuals here or their income, that comes later. Click to enlarge

How much is each household getting?

The maximum amount was ISK 4 million, no matter how much your indexed loan had grown due to inflation. Another interesting infographic from the government, same source, same colours. The gist: 90% of individuals are getting less than ISK 2.1 million (roughly USD 17,000) written off and 90% of couples are getting less than ISK 2.8 million (USD 22,600) written off. Average individual is getting ISK 1.1 million (USD 8,900) written off and in the case of couples the average is ISK 1.5 million (USD 12,000). Click to enlarge.

Cumulative frequency graph of the one above. Click to enlarge.

The income-distribution of the receivers of write-offs?

It looks as if it is mainly the ones on the lower end and the ones in the middle of the income distribution. 75% of the total ISK 80 billion will go to individuals and couples with less than ISK 7 million (USD 56,400) and ISK 16 million (USD 129,000) respectively in annual income (the average Icelander has ISK 6.2 million in annual income). Do note, of course, that those figures are only regarding the ISK 80 billion part. The wealthy will be the ones that will benefit most from the tax-free allowance to use their private pension funds to pay down their debt. The reason, of course, is that they are wealthy and most likely to have significant private pension in the first place.

Diving in a bit deeper we see that the write-offs are not really for the low- or no-income people. This is sort of to be expected: if you don't have income you don't get a loan and if you don't have a loan you don't get a write-off. Ergo: no income, no write-off. The government itself notes that "the majority of the write-offs are for individuals who owe between ISK 10-20 million and couples who owe ISK 20-30 million."

The distribution towards the poor could have been better, especially since the economic impact of such distribution is more positive than when the rich get the extra buck.

How old are the receivers of write-offs?

Around 40 years old, on average. The graph below shows the total amount of debt written off (y-axis) depending on the age of the debtor (x-asis). Click to enlarge.

How much will the monthly payments drop?

Depends, obviously, on each loan. The average is around 13-14% or, for most loans, around ISK 15,000-20,000 (USD 120-160). This varies hugely depending on the loan.

And the households' balance sheets after the write-offs?

Gross household debt is down to 94% of GDP.

And the economic consequences of it all?

Overall, should be favourable although the risk is that it's not going to last (I've mentioned this before).

Disposable income of households grows by 17% according to the government and so we can imagine that consumption is going to get a boost. Whether that's going to be sustainable is a whole different story. One third of the CPI basket is imports and a boost in consumption could put the trade balance in the red, threatening the fragile recovery we have in the current account and the accumulation of foreign reserves, which is important if we're ever going to lift the capital controls. Also, a boost in consumption might trigger a run in inflation although the exchange rate of the ISK, which is stable thanks to the capital controls, and low growth in wage demands will probably be more important factors behind the inflation development than a boost in consumption demand.

But there is another unresolved issue regarding the inflationary effects. The government is pumping ISK 80 billion into the economy and taking ISK 80 billion from the bankrupt estates of the banks (or that's the plan). But the bankrupt estates are not part of the "everyday economy" of Mr. Jónsson and Ms. Jónsdóttir. Therefore, even if the budget deficit should be none because of the government action it boosts aggregate demand in the economy by ISK 80 billion (Gunnar Tomasson, economist, was the first one to point this out). On top of this comes the favourable effects of using private pension funds to pay down your debt which boosts your disposable income, ergo, it's a boost in aggregate demand. Therefore, we can assume that the whole action is, at least partially, inflationary (it may well lead to increased production and employment instead, especially if investment picks up simultaneously, but that is unlikely while the unclear promises about the abolishment of capital controls linger about). This inflationary pressure can make the whole matter self-defeating since the principals of indexed debts, which are being written down by ISK 80 billion, are linked to the CPI. The risk is that IF inflation picks up the amount written off in this "jubilee" is going to quickly pile up again on the principal of household debt since that's how indexation in Iceland works. Then, we'd be back to square one.

So whatever happens, keep inflation down! That means to keep the capital controls in place for a while (sorry, dear government: you can't eat the cake and have it too) and to keep nominal wage demands on the moderate side.

Next year or so of Iceland's economic development is going to be interesting!

No comments:

Post a Comment