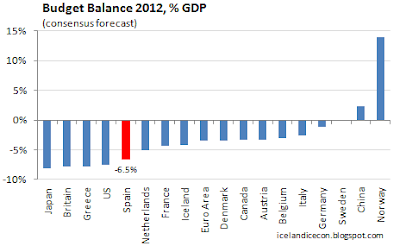

First, this is how the projected budget deficit of Spain compares to other economies. Data comes from the newest issue of The Economist (Iceland's budget deficit figure is full year 2011). According to the WSJ, the aim is to get Spain's deficit down to 6.3% this year (instead of previous target of 5.3%) and 4.5% in 2013. By 2014, the deficit is to dip back under the 3% Maastricht line: 2.8%.

Projected budget deficits for 2012. Data from The Economist

The aim of the game is to get the interest rates down so Spain (and the EZ as a whole) doesn't collapse. That makes sense, looking at this scatter plot below: an obvious negative correlation between budget balances and interest rates, meaning that if a country is suffering increased budget imbalances, the interest rates on its government bonds tend to go up.

"Don't spend your money or we'll charge you extra high interest rates"

But oops, that's not what it seems to be when we look at countries with their own currencies and not the euro. They seem to be able to spend all they want without fearing higher nominal rate of interest. Yes, I know the 1970s and 1980s stories. But in times of dull economic activities, as is the case nowadays, it seems quite all right for the government to spend all it wants as long as the economy is using its own currency.

"You can spend your money all you want, as long as you can create it yourself"

Both scatter plots above have outliers that could possibly be bending the fundamental relationship. So if we skip some notable outliers (Iceland, Norway [who has positive budget balance amounting to 13% of GDP anyway?], Greece, Spain, Italy) we get the following scatter plot.

"Please borrow and spend, we'll charge you lower rate of interest if you do so!"

Two things to notice about this final plot:

- it seems the relationship between budget balance and the rate of interest on government bonds is positive, completely contrary to neoclassical theory: if the state increases its budget balance, it will be charged higher rate of interest.

- all the EZ economies, except Germany, are above the trendline. Denmark is of course pegged to the euro, we can argue whether we should put it with the EZ economies or not.

So those fiscal-neoclassicals (commonly but incorrectly known as "Keynesians") out there might be right but maybe only half-right: we can end this depression now if we use the public finances to increase monetary demand in the economy and give people a chance to repay their debts, but only if the economies in question have their own currencies; the EZ economies would find this spend-and-survive strategy "a bit more" difficult.

Good luck Spain on cutting down the deficit, get unemployment down to humane levels and end this depression. You're going to need it!

No comments:

Post a Comment