The plan can be found here. The essence of it is to make it a constitutional duty to run a balanced government budget - that must be a German idea since, I believe, this mechanism is already in place in the German constitution. If there will be a violation of the -3% budget rule in the Maastricht treaty, some automatic process is to kick in to deal with the deficit. It is basically meant to be constitutionally impossible to break the -3% line. This they hope will stabilise the EZ - because as everybody knows, budget deficits are to blame for the crisis (no they are not!!) - and after a few years of stabilising austerity, Italy, Spain, Ireland and other peripheries will be just fine.

Sorry guys, ain't going to happen!

Budget deficits and public debt are not the only one to blame for the EZ crisis. Yes, Greece and Italy were running rather large deficits up until the crisis while public debt was monstrous in both economies. So it can easily be argued that the public finances cocktail in Greece and Italy, and even Portugal (which also had high private debt) was poisonous and one can easily argue that public debt is to blame in those economies.

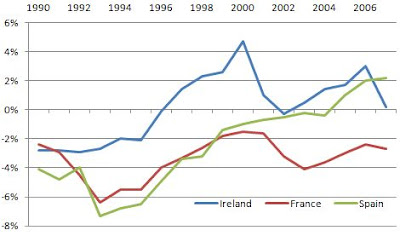

But that's not the case in Spain or Ireland. Both countries were running a balanced budget, a lot more balanced than France. The crisis in Spain and Ireland wasn't because of public debt, as one can argue for in the case of Greece, Italy and Portugal, but private debt. The Spanish and Irish went on a private spending spree, buying and building houses as there was no tomorrow. When the private debt bubble collapsed the State got the financial sector straight into its arms and lack of private economic activity caused a skyrocketing public deficit. Has everybody forgotten AIB in Ireland and the Spanish cajas?

Public deficit as % of GDP in three countries, 1990 - 2007

The problem in the EZ isn't the the same all over it and therefore you cannot fix it with a uniform plan all over the EZ. That sort of plan is destined to fail; you can't fix a private debt bubble with fiscal austerity! On the contrary should you run deficits to get the private economy into investing and running the economy again. Japan is the most obvious case of the obvious need for government economic support after a private debt bubble burst.

Exactly because the new EZ plan rules out the possibility of supporting an orderly deflation of a private debt bubble with public spending the plan is not only destined to fail but may well speed up the break up of the EZ. If national governments cannot use the borrowing and spending power of the State to meet the need of economic support at the time of private debt deflation the discrepancy of economic activity between EZ members will only get worse.

No comments:

Post a Comment