Edit: For those of you who don't know, Iceland's government recently presented the whole debt relief action. As of this morning, each individual who gets a debt relief (91,000 in total or a bit less than a third of the total population) knew how much (s)he is going to get. Here are some news about the whole thing in English:

Mbl.is

Iceland Review

Iceland Review

The Reykjavik Grapevine

=============

Well, not a full-blown jubilee, but a partial one. And no clay tablets were broken or dissolved during this one.

I described in this post the Icelandic debt jubilee and how they were going to do it. Now, a milestone in the matter has been reached: 90% of the applicants have had their loans looked at and a judgement has been reached whether and how much write-off of debt they're going to get. This post describes the bottom line and delves quickly into some potential consequences.

And the source of info & graphs:

The Powerpoint slides from the government

First of all, how much was cancelled?

ISK 80 billion (4.3% of GDP) of indexed household debt. On top of that comes the tax-free allowance to use private pension funds (the third pillar of the pension system) to pay down debt, total ISK 70 billion.

How much will it cost the government?

ISK 100 billion: ISK 80 billion due to the direct write-offs and ISK 20 billion due to lost tax income from private pension funds being paid out. The ISK 80 billion is immediate but the rest is distributed over decades.

How much time will this take?

Effect will be pretty much immediate on the cash-flows of households. The original loan that is being written down will be divided into "New Loan" and "Write-Off" parts. The New Loan will be an exact replica of the original loan minus the amount written off. The Write-Off part will stay on the balance sheet of the household and be written off in chunks. The original plan was to write it off in four years but instead they're going to do it one year.

Four years or one year, does it matter?

Probably not. Strictly speaking, the net-debt situation of the household doesn't improve until the Write-Off part is gone. Some might think that speeding up the cancellation of this debt may speed things up a bit in the economy (ease the access to credit to households) but why so? After all, even if it had been there for four years or 40 years, if the household never pays a penny of the debt and the bank/prospective lender of the household looks rationally at the financial situation of the household as a prospective borrower, why should it matter?

Who's getting his debts cancelled?

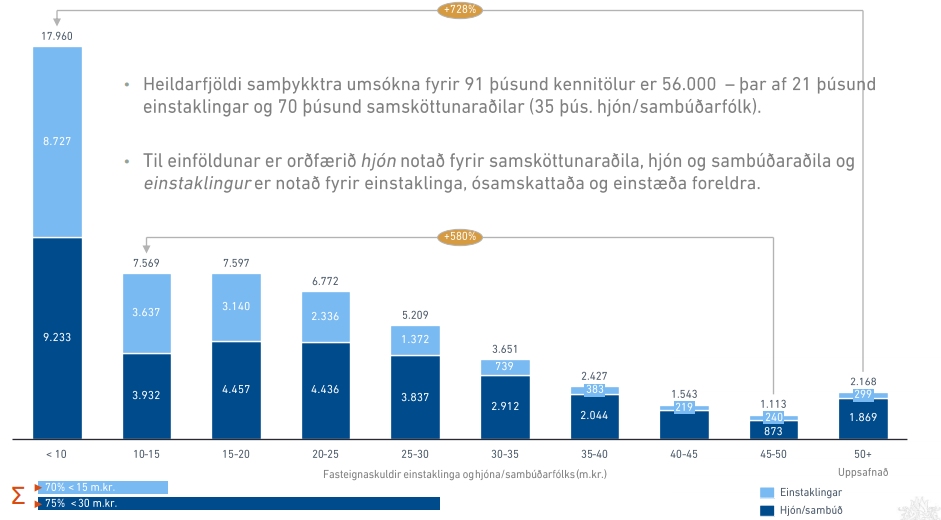

Here is an interesting figure from the powerpoint slides of the government. The columns are number of individuals (dark blue) and couples (light blue) which are getting a part of their debt cancelled. The x-axis is the amount of the original loan (in ISK millions). So, basically, looking at the numbers, it's the ones that are in low debt that are getting their loans written down. Do note that we can't say anything about the ages of the individuals here or their income, that comes later. Click to enlarge

How much is each household getting?

The maximum amount was ISK 4 million, no matter how much your indexed loan had grown due to inflation. Another interesting infographic from the government, same source, same colours. The gist: 90% of individuals are getting less than ISK 2.1 million (roughly USD 17,000) written off and 90% of couples are getting less than ISK 2.8 million (USD 22,600) written off. Average individual is getting ISK 1.1 million (USD 8,900) written off and in the case of couples the average is ISK 1.5 million (USD 12,000). Click to enlarge.

Cumulative frequency graph of the one above. Click to enlarge.

The income-distribution of the receivers of write-offs?

It looks as if it is mainly the ones on the lower end and the ones in the middle of the income distribution. 75% of the total ISK 80 billion will go to individuals and couples with less than ISK 7 million (USD 56,400) and ISK 16 million (USD 129,000) respectively in annual income (the average Icelander has ISK 6.2 million in annual income). Do note, of course, that those figures are only regarding the ISK 80 billion part. The wealthy will be the ones that will benefit most from the tax-free allowance to use their private pension funds to pay down their debt. The reason, of course, is that they are wealthy and most likely to have significant private pension in the first place.

Diving in a bit deeper we see that the write-offs are not really for the low- or no-income people. This is sort of to be expected: if you don't have income you don't get a loan and if you don't have a loan you don't get a write-off. Ergo: no income, no write-off. The government itself notes that "the majority of the write-offs are for individuals who owe between ISK 10-20 million and couples who owe ISK 20-30 million."

The distribution towards the poor could have been better, especially since the economic impact of such distribution is more positive than when the rich get the extra buck.

How old are the receivers of write-offs?

Around 40 years old, on average. The graph below shows the total amount of debt written off (y-axis) depending on the age of the debtor (x-asis). Click to enlarge.

How much will the monthly payments drop?

Depends, obviously, on each loan. The average is around 13-14% or, for most loans, around ISK 15,000-20,000 (USD 120-160). This varies hugely depending on the loan.

And the households' balance sheets after the write-offs?

Gross household debt is down to 94% of GDP.

And the economic consequences of it all?

Overall, should be favourable although the risk is that it's not going to last (I've mentioned this before).

Disposable income of households grows by 17% according to the government and so we can imagine that consumption is going to get a boost. Whether that's going to be sustainable is a whole different story. One third of the CPI basket is imports and a boost in consumption could put the trade balance in the red, threatening the fragile recovery we have in the current account and the accumulation of foreign reserves, which is important if we're ever going to lift the capital controls. Also, a boost in consumption might trigger a run in inflation although the exchange rate of the ISK, which is stable thanks to the capital controls, and low growth in wage demands will probably be more important factors behind the inflation development than a boost in consumption demand.

But there is another unresolved issue regarding the inflationary effects. The government is pumping ISK 80 billion into the economy and taking ISK 80 billion from the bankrupt estates of the banks (or that's the plan). But the bankrupt estates are not part of the "everyday economy" of Mr. Jónsson and Ms. Jónsdóttir. Therefore, even if the budget deficit should be none because of the government action it boosts aggregate demand in the economy by ISK 80 billion (Gunnar Tomasson, economist, was the first one to point this out). On top of this comes the favourable effects of using private pension funds to pay down your debt which boosts your disposable income, ergo, it's a boost in aggregate demand. Therefore, we can assume that the whole action is, at least partially, inflationary (it may well lead to increased production and employment instead, especially if investment picks up simultaneously, but that is unlikely while the unclear promises about the abolishment of capital controls linger about). This inflationary pressure can make the whole matter self-defeating since the principals of indexed debts, which are being written down by ISK 80 billion, are linked to the CPI. The risk is that IF inflation picks up the amount written off in this "jubilee" is going to quickly pile up again on the principal of household debt since that's how indexation in Iceland works. Then, we'd be back to square one.

So whatever happens, keep inflation down! That means to keep the capital controls in place for a while (sorry, dear government: you can't eat the cake and have it too) and to keep nominal wage demands on the moderate side.

Next year or so of Iceland's economic development is going to be interesting!

About the Icelandic Economy, the European Economic Crisis, debt and deflation. "Words ought to be a little wild..."

Tuesday, 11 November 2014

Saturday, 8 November 2014

Interest rates and national savings in Iceland

Pétur Blöndal, MP of the Independence Party in Iceland, recently claimed that the reason for the high rate of interest in Iceland is that people don't save. In other words, if the people would save more and the amount of savings rise the rate of interest would come down. I beg to differ.

First, let's test Blöndal's hypothesis in the historical context: increased national savings would lead to a lower rate of interest. This implies a negative correlation between the rate of interest and the level of national savings: savings go up, interest rates go down.

The reality, however, glancing at the data (graphed below), is that the correlation between the two different factors is positive, and quite high as well: 0.77 to be specific.

Besides the point that this refutes Blöndal's claim immediately, this has to be explained. Why is there a positive correlation between the rate of interest and the level of national savings?

Now, there are three potential reasons for this.

First, the causation is the other way around: it's not savings that influence the rate of interest but the rate of interest pulling savings with it. After all, the higher rate of interest you get for saving a part of your income, the more eager you should be to save. This indicates that changes in the real long term interest rates takes place first and the national savings are influenced, moving thereafter.

This can be tested with a Granger-causality test using the data above, the results of which are the following: the series fail the unit-root tests but they are nonetheless not cointegrated. Not surprisingly then, we see no Granger-causality in the data. Ergo: higher rate of interest does not cause, or lead to, more national savings, according to this dataset. I am therefore going to reject this explanation.

Another potential explanation is Keynes's Liquidity Preference Theory of Interest. Keynes's insight was simple: savings is a two-decision process. First, your decide how much you want to save. Then, you decide how you want to save. If your liquidity preference is high you prefer to save in a very liquid form of savings, such as money or money-equivalents. This you do if you are fearful about the future. If you are not fearful about the future chances are you first of all don't want to save that much - what the heck for anyway, you'll be fine! - and second, you prefer to buy illiquid assets that are not easily used or transferable into money. This leads to a lower rate of interest since the demand for illiquid financial assets goes up and their price as well.

Keynes's LPT could explain both phenomena shown on the graph: if you are fearful about the future you a) prefer to save more and b) you demand a higher price (rate of interest) for departing with the ability of using your existing savings as money to pay for upcoming expenses, perfectly foreseen or not. This would explain why there is a positive correlation between the rate of interest and the level of national savings.

(It complicates things that the rate of interest used in the graph is the 10 year government bond, corrected by the changes in the CPI. This is the "risk free" rate and may well not be the appropriate rate of interest to look at. There is a plethora of interest rates in the economy and many of them are based on the "risk free" rate with a certain, ever-changing, premium set by the market. Looking at the premium might be more informative than looking at the risk free rate but data for this is not easily available in the case of Iceland).

Then, there is the third potential answer, offered by Jónsson (1999) at the Central Bank of Iceland, who, having exclaimed an apparent contradiction in the fact that national savings went down as the rate of interest went up in the 1980s, the following answer: the stock of existing wealth (accumulated saving) offers such high cash-flows in the form of interest that new savings is not wanted. In other words, once the stock of wealth has reached a certain level the rate of interest stops having any significant effect on the level of new savings (which is a flow variable).

This is hard to accept at face value but there is perhaps a grain of truth in this hypothesis. It basically says that people become complacent with what they have once they have reached a certain level of financial wealth and interest rate changes lose their influence on savings. Although it does not explain very well the high correlation between the two time series seen in the graph above, something that Keynes's LPT does, we should remember that Masson, Bayoumi and Samiey (1998) found that increased income (GDP per capita) lead, in low-income countries, to an increase in savings while, in the case of high-income countries, it lead to a decrease in savings. So, effectively, that people become happy with what they have once they've reached a certain level of savings is not an unlikely explanation. But, again, Jónsson's idea hardly explains the high and positive correlation between the rate of interest and national savings.

Obviously, looking at this matter without considering e.g. the level of income is incomplete. Lower level of income may force national savings to go down since people don't have anything left, after their everyday expenditures, to save. But whatever the reason is - curious minds with more time on their hands than I are encouraged to try and find out - the lesson is that Blöndal is certainly not right: increasing national savings would not lower the rate of interest, except, of course, completely coincidentally.

First, let's test Blöndal's hypothesis in the historical context: increased national savings would lead to a lower rate of interest. This implies a negative correlation between the rate of interest and the level of national savings: savings go up, interest rates go down.

The reality, however, glancing at the data (graphed below), is that the correlation between the two different factors is positive, and quite high as well: 0.77 to be specific.

National savings and the rate of interest in Iceland show a positive correlation, not a negative one

Besides the point that this refutes Blöndal's claim immediately, this has to be explained. Why is there a positive correlation between the rate of interest and the level of national savings?

Now, there are three potential reasons for this.

First, the causation is the other way around: it's not savings that influence the rate of interest but the rate of interest pulling savings with it. After all, the higher rate of interest you get for saving a part of your income, the more eager you should be to save. This indicates that changes in the real long term interest rates takes place first and the national savings are influenced, moving thereafter.

This can be tested with a Granger-causality test using the data above, the results of which are the following: the series fail the unit-root tests but they are nonetheless not cointegrated. Not surprisingly then, we see no Granger-causality in the data. Ergo: higher rate of interest does not cause, or lead to, more national savings, according to this dataset. I am therefore going to reject this explanation.

Another potential explanation is Keynes's Liquidity Preference Theory of Interest. Keynes's insight was simple: savings is a two-decision process. First, your decide how much you want to save. Then, you decide how you want to save. If your liquidity preference is high you prefer to save in a very liquid form of savings, such as money or money-equivalents. This you do if you are fearful about the future. If you are not fearful about the future chances are you first of all don't want to save that much - what the heck for anyway, you'll be fine! - and second, you prefer to buy illiquid assets that are not easily used or transferable into money. This leads to a lower rate of interest since the demand for illiquid financial assets goes up and their price as well.

Keynes's LPT could explain both phenomena shown on the graph: if you are fearful about the future you a) prefer to save more and b) you demand a higher price (rate of interest) for departing with the ability of using your existing savings as money to pay for upcoming expenses, perfectly foreseen or not. This would explain why there is a positive correlation between the rate of interest and the level of national savings.

(It complicates things that the rate of interest used in the graph is the 10 year government bond, corrected by the changes in the CPI. This is the "risk free" rate and may well not be the appropriate rate of interest to look at. There is a plethora of interest rates in the economy and many of them are based on the "risk free" rate with a certain, ever-changing, premium set by the market. Looking at the premium might be more informative than looking at the risk free rate but data for this is not easily available in the case of Iceland).

Then, there is the third potential answer, offered by Jónsson (1999) at the Central Bank of Iceland, who, having exclaimed an apparent contradiction in the fact that national savings went down as the rate of interest went up in the 1980s, the following answer: the stock of existing wealth (accumulated saving) offers such high cash-flows in the form of interest that new savings is not wanted. In other words, once the stock of wealth has reached a certain level the rate of interest stops having any significant effect on the level of new savings (which is a flow variable).

This is hard to accept at face value but there is perhaps a grain of truth in this hypothesis. It basically says that people become complacent with what they have once they have reached a certain level of financial wealth and interest rate changes lose their influence on savings. Although it does not explain very well the high correlation between the two time series seen in the graph above, something that Keynes's LPT does, we should remember that Masson, Bayoumi and Samiey (1998) found that increased income (GDP per capita) lead, in low-income countries, to an increase in savings while, in the case of high-income countries, it lead to a decrease in savings. So, effectively, that people become happy with what they have once they've reached a certain level of savings is not an unlikely explanation. But, again, Jónsson's idea hardly explains the high and positive correlation between the rate of interest and national savings.

Obviously, looking at this matter without considering e.g. the level of income is incomplete. Lower level of income may force national savings to go down since people don't have anything left, after their everyday expenditures, to save. But whatever the reason is - curious minds with more time on their hands than I are encouraged to try and find out - the lesson is that Blöndal is certainly not right: increasing national savings would not lower the rate of interest, except, of course, completely coincidentally.

Thursday, 6 November 2014

The State of the Icelandic Economy

Despite the long silence I am quite healthy and fine. As I've got time from my PhD work - hopefully in its final stretches - I've got time to revive this blog, at least for this one time. Not the least because the Icelandic economy is, according to the governor of the central bank, in such a state that many other countries "envy" Icelanders.

Or so the story goes.

On the surface

True, on the surface, the economy is doing pretty splendidly! Unemployment is down, economic growth - this incomplete and deficient measurement of prosperity - is up. Inflation is down and has been kept down for a long enough time for the Central Bank to lower its policy rates, now 5.75%.

This is the story told by numbers. But, unfortunately, these numbers are not the whole story. They tell a part of it but the don't tell the whole of, just like the surface doesn't tell us what is under it.

In the murky waters

First, let's check out the inflation figures. Inflation in Iceland is heavily influenced by the supply-side factor that the exchange rate is. Roughly one-third of the CPI, which is the basis of the inflation figure as it is measured in Iceland (let's not argue here whether we should use RPI, CPI or whatever else as a measurement of inflation) is from imported goods. Therefore, the stability, as of late, of the exchange rate is a huge factor why the rate of inflation has gone down so much.

(Let's not forget that the value of the exchange rate has been influenced to be stable below what it otherwise would have been: the CBI has been buying FX, therefore kept the value of the ISK down. But, at the same time, the CBI has been careful to try and keep the exchange rate as stable as it can. So "weak but stable" can be used to describe what the CBI has been doing on the FX market.)

So supply-price factors, kept in check by a stable exchange rate and low nominal wage increases, have contributed to the stability of consumer prices. But the other reason for low inflation is simple: lack of demand!

People are not spending as much as they used to. Gone are the days of consumer-pulled GDP growth like in late 90s and pre-2008 when consumption was growing almost at double figures annually and pulling GDP growth with it. But nowadays, the consumption growth is hardly half of its former glory and GDP growth is pulled by the tourist.

This lack of consumption is normal given that real wages are only just now getting back to their pre-2008 levels.

And the basis of any long-term prosperity, investment, is sluggish at best. I reckon it would have to be at least third higher than it actually is to be considered normal.

So sluggish is investment in fact that the stock of real capital is depreciating. And last time I checked, it is pretty darn difficult to maintain production with machinery that is gradually depreciating.

And then comes other not so rosy pictures and developments: doctors are on a strike, rental prices are increasing fast, there is a shortage of affordable housing (at least, judging from the media) and 4,500-6,000 people gathered outside the parliament a few days ago to protest. So whatever the governor says, "envious" economic situation is in the eye of the beholder.

My overall judgement on the economy hasn't changed and is the following.

The external sector, tourism in particular, is responsible for the GDP growth. Hotels are popping up due to this, explaining the small increment in investment that there is. The growth in tourism was fuelled by the fall in the exchange rate of the currency and has allowed the central bank to gather some FX ammunition. In the meanwhile, lack of domestic demand and stability of the exchange rate has lead to a fall in the rate of inflation. Unemployment has come down, mainly due to effective demand being held up from the external sector.

In the meanwhile, investment is low which for the long term will keep the economy down compared to its potential. Investment is low because there is huge uncertainty about what and when something will happen to the capital controls. The consequential changes in the exchange rate of the currency can have devastating effects on any investment project (inflation, wage demands, changes in interest rates, etc.). Ergo: nobody invests while nobody knows what and when something will happen to the capital controls (Business Iceland, a union of employers, advocates an immediate abolishment of the capital controls but I, in July, compared that to blowing up a dam with the whole nation below it. So, basically, forget it!).

Talking about proper long-term recovery in Iceland is fictional while the capital controls are still there and the plan, however vague and unbelievable it is, is to lift them. But the capital controls are exactly what keeps the current situation viable: behind them, people know what the exchange rate is going to be in the nearest future, they don't have to face the reality of potentially massive outflows of capital and politicians can complacently talk about something else than the economy.

The capital controls are the culprit behind the lack of investment, which is what keeps the long-term prospects of the economy down, but, thanks to them, the exchange rate is stable, inflation is down and the weak stability in the economy is their offspring. Like my former boss and teacher put is so eloquently: "This is all kept together by the capital controls."

Their declared abolishment, however it is going to be done, is going to be like going cold-turkey for the heroin addict.

Has anyone actually considered this: maybe it would be better, from an economic point of view, to simply accept and declare that the capital controls will be there?

Then people would not have to be so uncertain about them going or how they would go. Immediately, investment planning would become more viable. "Since the capital controls are going to stay we can make a long-term plan about the cash flows of the investment project" might somebody think. Investment would pick up, sustainable economic growth as well and effective demand from something else than just tourists come back.

Or so the story goes.

On the surface

True, on the surface, the economy is doing pretty splendidly! Unemployment is down, economic growth - this incomplete and deficient measurement of prosperity - is up. Inflation is down and has been kept down for a long enough time for the Central Bank to lower its policy rates, now 5.75%.

Inflation (source for all graphs: Statistics Iceland)

Unemployment

GDP growth

This is the story told by numbers. But, unfortunately, these numbers are not the whole story. They tell a part of it but the don't tell the whole of, just like the surface doesn't tell us what is under it.

In the murky waters

First, let's check out the inflation figures. Inflation in Iceland is heavily influenced by the supply-side factor that the exchange rate is. Roughly one-third of the CPI, which is the basis of the inflation figure as it is measured in Iceland (let's not argue here whether we should use RPI, CPI or whatever else as a measurement of inflation) is from imported goods. Therefore, the stability, as of late, of the exchange rate is a huge factor why the rate of inflation has gone down so much.

(Let's not forget that the value of the exchange rate has been influenced to be stable below what it otherwise would have been: the CBI has been buying FX, therefore kept the value of the ISK down. But, at the same time, the CBI has been careful to try and keep the exchange rate as stable as it can. So "weak but stable" can be used to describe what the CBI has been doing on the FX market.)

So supply-price factors, kept in check by a stable exchange rate and low nominal wage increases, have contributed to the stability of consumer prices. But the other reason for low inflation is simple: lack of demand!

People are not spending as much as they used to. Gone are the days of consumer-pulled GDP growth like in late 90s and pre-2008 when consumption was growing almost at double figures annually and pulling GDP growth with it. But nowadays, the consumption growth is hardly half of its former glory and GDP growth is pulled by the tourist.

Consumption in Iceland, quarterly data

This lack of consumption is normal given that real wages are only just now getting back to their pre-2008 levels.

Median real wages in ISK thousands (2013 prices)

And the basis of any long-term prosperity, investment, is sluggish at best. I reckon it would have to be at least third higher than it actually is to be considered normal.

Investment/GDP

So sluggish is investment in fact that the stock of real capital is depreciating. And last time I checked, it is pretty darn difficult to maintain production with machinery that is gradually depreciating.

Stock of real capital (2005=100)

And then comes other not so rosy pictures and developments: doctors are on a strike, rental prices are increasing fast, there is a shortage of affordable housing (at least, judging from the media) and 4,500-6,000 people gathered outside the parliament a few days ago to protest. So whatever the governor says, "envious" economic situation is in the eye of the beholder.

My overall judgement on the economy hasn't changed and is the following.

The external sector, tourism in particular, is responsible for the GDP growth. Hotels are popping up due to this, explaining the small increment in investment that there is. The growth in tourism was fuelled by the fall in the exchange rate of the currency and has allowed the central bank to gather some FX ammunition. In the meanwhile, lack of domestic demand and stability of the exchange rate has lead to a fall in the rate of inflation. Unemployment has come down, mainly due to effective demand being held up from the external sector.

In the meanwhile, investment is low which for the long term will keep the economy down compared to its potential. Investment is low because there is huge uncertainty about what and when something will happen to the capital controls. The consequential changes in the exchange rate of the currency can have devastating effects on any investment project (inflation, wage demands, changes in interest rates, etc.). Ergo: nobody invests while nobody knows what and when something will happen to the capital controls (Business Iceland, a union of employers, advocates an immediate abolishment of the capital controls but I, in July, compared that to blowing up a dam with the whole nation below it. So, basically, forget it!).

Talking about proper long-term recovery in Iceland is fictional while the capital controls are still there and the plan, however vague and unbelievable it is, is to lift them. But the capital controls are exactly what keeps the current situation viable: behind them, people know what the exchange rate is going to be in the nearest future, they don't have to face the reality of potentially massive outflows of capital and politicians can complacently talk about something else than the economy.

The capital controls are the culprit behind the lack of investment, which is what keeps the long-term prospects of the economy down, but, thanks to them, the exchange rate is stable, inflation is down and the weak stability in the economy is their offspring. Like my former boss and teacher put is so eloquently: "This is all kept together by the capital controls."

Has anyone actually considered this: maybe it would be better, from an economic point of view, to simply accept and declare that the capital controls will be there?

Then people would not have to be so uncertain about them going or how they would go. Immediately, investment planning would become more viable. "Since the capital controls are going to stay we can make a long-term plan about the cash flows of the investment project" might somebody think. Investment would pick up, sustainable economic growth as well and effective demand from something else than just tourists come back.

Friday, 10 January 2014

An Icelandic "Fisher Moment"?

Irving Fisher is one of those economists that many know. At least, many economists know his work, and some of his work is better known, and acknowledged, than other. Fisher is the guy who brought us The Fisher Equation (real interest rates, nominal interest rates and inflation), the Quantity Theory of Money (PY=MV) and the International Fisher Effect (closely related to Interest Rate Parity between currencies).

He also (in)famously had the opinion, only a few days before the 1929 stock crash, that stock prices in the US had reached a "permanently high plateau". That was truly a "whoops!" moment.

But he had the guts to admit it to himself that he had been wrong. He sat down and came up with the Debt Deflation Theory, which not only is a sensible theory where private debts matter for the overall economy and where one's debt is not simply another's asset, therefore netting out on the whole, but it is also rather the opposite of what he had been doing before.

The reason why I'm shortly reviewing this is that we may just have had a "Fisher Moment" - when somebody sits down and produces a work which is contrary to what he had done before - amongst the Icelandic academics in economics. And the candidate: Fridrik Mar Baldursson, Professor of Economics at Reykjavik University. He's working with Richard Portes of London Business School.

Baldursson and Portes: post-crash

Baldursson and Portes just had a piece on vox.eu where they point out that the Icelandic banks had "gambled for their resurrection". Today, "everybody" in Iceland "knows" this but nobody had put the effort into showing it properly with data, except maybe the Special Investigation Committee that looked into the banks and many, many, many other things after the crash. Too bad their 3,000 page report was only written in Icelandic (besides some excerpts) and never translated into a language, such as English, that would open it better for academic and other types of use outside of Iceland.

Anyway, Baldursson and Portes have an interesting piece on vox.eu which is worth reading. They focus on the banks' attempts to save themselves by practically falsifying their share prices: buy the shares themselves and just before they cross the 5% mark of total holdings, which demands a public notification to the stock exchange with all the possible and impossible repercussions to their businesses if the general public actually learns that they are buying themselves, they unload their own stock onto somebody who is willing to take out a loan, at the bank itself, and buy the stocks. Of course, the only collateral is the stock itself. This the banks did repeatedly and Baldursson and Portes even hint at that this was the practice all the way back in 2005, whole three years before the music stopped.

Furthermore, the banks (or their managers, for "banks" do not take any decisions) focused on bailing out the owners of the banks before anybody else (check out the presentation for examples). What did William K. Black say again: "The best way to rob a bank is to own one." Well, touché, or what? The FSA in Iceland also gets a deserved piece of the action: "These numbers immediately raise the question of how – or even whether – the Financial Services Authority monitored lending to enforce rules on large exposures."

Baldursson's and Portes's article is most welcome. They use data from the report from the special investigation committee which, I believe, haven't been seen in English before. They also take time to point out how notoriously, even criminally, the banks were eschewing the market and bailing out their friends before anybody else. Well done!

But I'd like to point out at least two issues. And I should say immediately that I put the former point, here below, forward with only an access to the vox article and not the CEPR version, which is longer and more detailed. Slides can be found on CBI's website.

ONLY the banks?

Baldursson and Portes seem to have the opinion that it was only, or at least mainly, the banks that were gambling for their resurrection.

But that's not true! Everybody that were calling the shots were gambling for their resurrection!

Just an example: the Central Bank of Iceland. Besides the hard-currency loans to Glitnir and Kaupthing at the height of the storm in September 2008 the Central Bank of Iceland was desperately trying to keep the banks afloat. A mere glimpse at the outstanding REPO agreements between the CBI and the banks is enough to see the scramble for anything, just anything at all, that had any credit-clearing power whatsoever! The scramble for cash was so severe that the pool of all secure and applicable collateral was long depleted. To try and keep the banks afloat - "gamble for their resurrection" - the CBI expanded, or its managers to be exact, their definition of applicable collateral: financial institutions' own notes and bonds were made REPOable. And although the banks couldn't use their own notes and bonds that was easy to work around simply by adding another third bank, say a small bank or a savings bank (lets not get into any names...), and pay it a small fee for getting the cash from the CBI, using a note from the original bank, and then channel the cash straight to the note-issuing bank. And 'hocus pocus' the bank now has liquidity!

This merry-go-round was of course such a serious gamble of resurrection on behalf of the CBI that the banks' notes and bonds were nicknamed "Love Letters" (i. ástarbréf). When the tempestuousness was at its highest point the total "Collateral Loans" to financial institutions were just shy of the ISK 500 billion mark. And I'd like to remind you that ISK 500 billion is back in 2008 roughly 1/3 of GDP: this isn't just some notes and coins! Would you like to compare that ratio to e.g. TARP or QE1/2/3? I'm sure that would be a fascinating comparison.

For some reason Blogger does not seem to allow me to upload the graph. So I'm making a link to it instead, straight to CBI's website

:

CBI's outstanding "Collateral Loans" to financial institutions, millions of ISK

And on this topic: Gudrun Johnsen, a lecturer at University of Iceland's Business School, has recently stepped forward saying that she had tried to warn the FSA, the Central Bank and the Ministry of Finance back in 2005 about the troubled waters the Icelandic banking system was wading into. Nobody listened for "it would have been a political suicide to stop the party".

Reminded me of Prince's words: "As long as the music is playing, you've got to get up and dance."

Baldursson and Portes: pre-crash

Times change and people, and their opinions, thankfully, with it. Baldursson and Portes seem e.g to have changed their opinions on the Icelandic banks since 2007.

In 2007 Baldursson and Portes wrote a report for the Icelandic Chamber of Commerce. The name of the report was The Internationalisation of Iceland's Financial Sector. There we can see them applaud the Icelandic banks and their strengths, short chain of command, their unusual yet profitable business model and responses to the 2006 mini crisis. Let's look at some excerpts, with some bold-font adjustments made by me:

And their recommendations were nothing related to the banks, but rather "adopt-the-euro-and-collect-more-data-and-the-CBI-should-do-something-else-than-encourage-the-carry-trade" sort of a general advice. Some of them make perfect sense (such as decreasing the use of indexation) but those recommendations would hardly have saved the banks or stopped them from collapsing:

Now, people make mistakes. And that's fine, and quite frankly even necessary if one wants to learn the real gist of things. So maybe Baldursson and Portes are learning, just like Fisher did after he had spoken about the "permanently high plateau". Baldursson and Portes made a mistake back in 2007 and now it seems as if their eyes have, at least partially, opened. They even mention their 2007 report in the presentation as being "too uncritical".

Well done guys! Seriously, it takes guts to admit one was wrong!

He also (in)famously had the opinion, only a few days before the 1929 stock crash, that stock prices in the US had reached a "permanently high plateau". That was truly a "whoops!" moment.

But he had the guts to admit it to himself that he had been wrong. He sat down and came up with the Debt Deflation Theory, which not only is a sensible theory where private debts matter for the overall economy and where one's debt is not simply another's asset, therefore netting out on the whole, but it is also rather the opposite of what he had been doing before.

The reason why I'm shortly reviewing this is that we may just have had a "Fisher Moment" - when somebody sits down and produces a work which is contrary to what he had done before - amongst the Icelandic academics in economics. And the candidate: Fridrik Mar Baldursson, Professor of Economics at Reykjavik University. He's working with Richard Portes of London Business School.

Baldursson and Portes: post-crash

Baldursson and Portes just had a piece on vox.eu where they point out that the Icelandic banks had "gambled for their resurrection". Today, "everybody" in Iceland "knows" this but nobody had put the effort into showing it properly with data, except maybe the Special Investigation Committee that looked into the banks and many, many, many other things after the crash. Too bad their 3,000 page report was only written in Icelandic (besides some excerpts) and never translated into a language, such as English, that would open it better for academic and other types of use outside of Iceland.

Anyway, Baldursson and Portes have an interesting piece on vox.eu which is worth reading. They focus on the banks' attempts to save themselves by practically falsifying their share prices: buy the shares themselves and just before they cross the 5% mark of total holdings, which demands a public notification to the stock exchange with all the possible and impossible repercussions to their businesses if the general public actually learns that they are buying themselves, they unload their own stock onto somebody who is willing to take out a loan, at the bank itself, and buy the stocks. Of course, the only collateral is the stock itself. This the banks did repeatedly and Baldursson and Portes even hint at that this was the practice all the way back in 2005, whole three years before the music stopped.

Furthermore, the banks (or their managers, for "banks" do not take any decisions) focused on bailing out the owners of the banks before anybody else (check out the presentation for examples). What did William K. Black say again: "The best way to rob a bank is to own one." Well, touché, or what? The FSA in Iceland also gets a deserved piece of the action: "These numbers immediately raise the question of how – or even whether – the Financial Services Authority monitored lending to enforce rules on large exposures."

Baldursson's and Portes's article is most welcome. They use data from the report from the special investigation committee which, I believe, haven't been seen in English before. They also take time to point out how notoriously, even criminally, the banks were eschewing the market and bailing out their friends before anybody else. Well done!

But I'd like to point out at least two issues. And I should say immediately that I put the former point, here below, forward with only an access to the vox article and not the CEPR version, which is longer and more detailed. Slides can be found on CBI's website.

ONLY the banks?

Baldursson and Portes seem to have the opinion that it was only, or at least mainly, the banks that were gambling for their resurrection.

But that's not true! Everybody that were calling the shots were gambling for their resurrection!

Just an example: the Central Bank of Iceland. Besides the hard-currency loans to Glitnir and Kaupthing at the height of the storm in September 2008 the Central Bank of Iceland was desperately trying to keep the banks afloat. A mere glimpse at the outstanding REPO agreements between the CBI and the banks is enough to see the scramble for anything, just anything at all, that had any credit-clearing power whatsoever! The scramble for cash was so severe that the pool of all secure and applicable collateral was long depleted. To try and keep the banks afloat - "gamble for their resurrection" - the CBI expanded, or its managers to be exact, their definition of applicable collateral: financial institutions' own notes and bonds were made REPOable. And although the banks couldn't use their own notes and bonds that was easy to work around simply by adding another third bank, say a small bank or a savings bank (lets not get into any names...), and pay it a small fee for getting the cash from the CBI, using a note from the original bank, and then channel the cash straight to the note-issuing bank. And 'hocus pocus' the bank now has liquidity!

This merry-go-round was of course such a serious gamble of resurrection on behalf of the CBI that the banks' notes and bonds were nicknamed "Love Letters" (i. ástarbréf). When the tempestuousness was at its highest point the total "Collateral Loans" to financial institutions were just shy of the ISK 500 billion mark. And I'd like to remind you that ISK 500 billion is back in 2008 roughly 1/3 of GDP: this isn't just some notes and coins! Would you like to compare that ratio to e.g. TARP or QE1/2/3? I'm sure that would be a fascinating comparison.

For some reason Blogger does not seem to allow me to upload the graph. So I'm making a link to it instead, straight to CBI's website

:

CBI's outstanding "Collateral Loans" to financial institutions, millions of ISK

And on this topic: Gudrun Johnsen, a lecturer at University of Iceland's Business School, has recently stepped forward saying that she had tried to warn the FSA, the Central Bank and the Ministry of Finance back in 2005 about the troubled waters the Icelandic banking system was wading into. Nobody listened for "it would have been a political suicide to stop the party".

Reminded me of Prince's words: "As long as the music is playing, you've got to get up and dance."

Baldursson and Portes: pre-crash

Times change and people, and their opinions, thankfully, with it. Baldursson and Portes seem e.g to have changed their opinions on the Icelandic banks since 2007.

In 2007 Baldursson and Portes wrote a report for the Icelandic Chamber of Commerce. The name of the report was The Internationalisation of Iceland's Financial Sector. There we can see them applaud the Icelandic banks and their strengths, short chain of command, their unusual yet profitable business model and responses to the 2006 mini crisis. Let's look at some excerpts, with some bold-font adjustments made by me:

There are macroeconomic imbalances, but their reflection in the external accounts is exaggerated. Despite problems with monetary policy and its effectiveness, the imbalances are being corrected, and the demonstrated, exceptional flexibility of the economy gives cause for optimism. We find that their effective response to the shock of early 2006 has made the banks much better placed now to cope with domestic macroeconomic shocks, credit events, and external liquidity constraints. They are well-managed, and their business models are strong.

We consider, therefore, that the current market premium on Icelandic banks is excessive relative to their risk exposure and in comparison with their Nordic peers. If this is in fact a country risk premium, we think it is not justified by Iceland’s economic situation.

...

Considering that all three banks have relatively high capital ratios to compensate for this different nature of their business model, the returns are even more acceptable. In addition, a high proportion of salaries in Icelandic banks are based on performance [with rather obvious incentives for the staff to take increased risks], indicating that the cost ratios would be much lower with simpler and less profitable operations. Taking that into consideration, the effect of the re-estimation on returns with no return on equities is rather modest

...

After the initial shock [in 2006, the Geyser crisis], the Icelandic financial sector responded quickly and decisively:

- deposit ratios are higher

- market funding has longer and more dispersed maturities

- cross-holdings have been mainly eliminated

- there is much greater transparency and information dissemination about the banks’

On the same criteria, Icelandic banks come out well in a comparison with Nordic peers – and their overall and core profitability is higher. That is despite the high CAD and Tier 1 ratios with which they counterbalance their equity exposure. They are well hedged against volatility in the krona. Stress tests by the FSA indicate that the banks can withstand quite extreme movements in market variables specific to Iceland. The banks have negligible exposure to the US subprime market, structured finance products, and related financial vehicles that have hit many financial institutions hard recently. Most fundamental, the banks exploit strong competitive advantage, arising from their entrepreneurial management, flat management structures, and unusual business models.

- structure and activities.

Yet in spite of their strong performance, Icelandic banks have lower ratings than their Nordic peers, and a much higher risk premium is being placed on their debt during the present turmoil. We see no justification for this in their risk exposure. This suggests that either the markets are not fully aware of their situation or markets place a country premium on the banks.

And their recommendations were nothing related to the banks, but rather "adopt-the-euro-and-collect-more-data-and-the-CBI-should-do-something-else-than-encourage-the-carry-trade" sort of a general advice. Some of them make perfect sense (such as decreasing the use of indexation) but those recommendations would hardly have saved the banks or stopped them from collapsing:

The possibility remains, however, of unilateral adoption of the euro as legal tender – ‘euroisation’. Euroisation would have potential advantages. In the ‘euroised’ economy, speculative attacks are no longer possible, so there is no currency risk, and domestic interest rates no longer incorporate that premium. There are typically lower transaction costs and greater transparency in policy. Using a stable foreign currency may itself implant or reinforce a ‘stability culture’.

...

The CBI is on an inflation target of 2.5%. Inflation driven by housing prices has however remained above the target for some time. The CBI has not had an easy task given the strong demand growth in Iceland in the last few years. And fiscal policy has not been supportive of monetary policy. Yet the policy rate of the CBI is very high compared with trading partners of Iceland, and monetary policy appears to be ineffective. There are several underlying reasons. First, the Housing Financing Fund is a major obstacle to the transmission of monetary policy. We agree with many other commentators, including the IMF, that the HFF’s role should be changed so that it no longer competes with banks in mortgage markets. Second, price indexation of financial contracts is widespread and tends to weaken monetary policy. Third, the CBI has undermined its own policy by linking its decisions to exchange rate developments. The high policy rate leads to distortions in the financial system, such as the large carry trade. If only for that reason, we urge the CBI to reconsider its strategy.

We strongly recommend efforts to improve the collection of data to account better for the balance of international income and the international investment position.

Now, people make mistakes. And that's fine, and quite frankly even necessary if one wants to learn the real gist of things. So maybe Baldursson and Portes are learning, just like Fisher did after he had spoken about the "permanently high plateau". Baldursson and Portes made a mistake back in 2007 and now it seems as if their eyes have, at least partially, opened. They even mention their 2007 report in the presentation as being "too uncritical".

Well done guys! Seriously, it takes guts to admit one was wrong!

Subscribe to:

Comments (Atom)